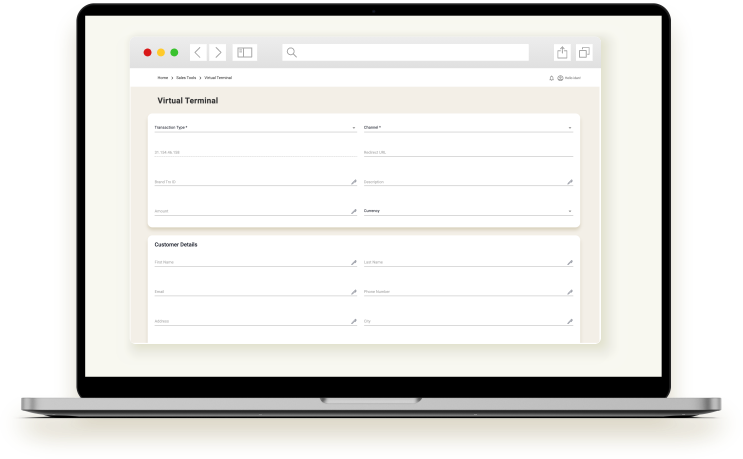

Wirtualny terminal

Nie ograniczaj swoich możliwości akceptacji płatności – skorzystaj z naszego rozwiązania do przetwarzania płatności za pomocą wirtualnego terminala, gdy wymagane jest prowadzenie płatności za pomocą MOTO (zamówienie pocztowe, zamówienie telefoniczne). Funkcja ta jest częścią Paragon, systemu bramek płatniczych Fibonatix , który pozwala na wprowadzenie szczegółów płatności klienta i przeprowadzenie płatności w czasie rzeczywistym, jednocześnie kontaktując się z klientem i tym samym usprawniając proces płatności.

-

Obsługa globalnych rynków docelowych

-

Intuicyjny pulpit monitorujący

-

Zgodność ze standardem PCI DSS

-

Akceptuj karty wiodących marek

-

Dedykowane wsparcie

-

Możliwości wywiadu biznesowego

Funkcja płatności za pomocą wirtualnego terminala Fibonatix pozwala na przetwarzanie płatności bez karty w środowisku transakcji „card-not-present” poprzez naszą bramkę płatniczą. Ta zdalna opcja zapewnia elastyczność w sposobie otrzymywania płatności. Wystarczy wprowadzić do wirtualnego terminala dane klienta dotyczące płatności niezależnie od tego, czy transakcja jest realizowana kartą kredytową czy debetową. Paragon, system bramek płatniczych Fibonatix, przewiduje również raportowanie transakcji w czasie rzeczywistym oraz filtrowanie danych, zapewniając bezproblemowe i kompleksowe monitorowanie.