This is the first in a series of posts and interviews featuring business owners who count on Fibonatix to power their businesses.

It took about ten years of online payment processing before Digital Course Company (DCC)* found a PSP that they could trust and that they felt really understood their needs as a company.

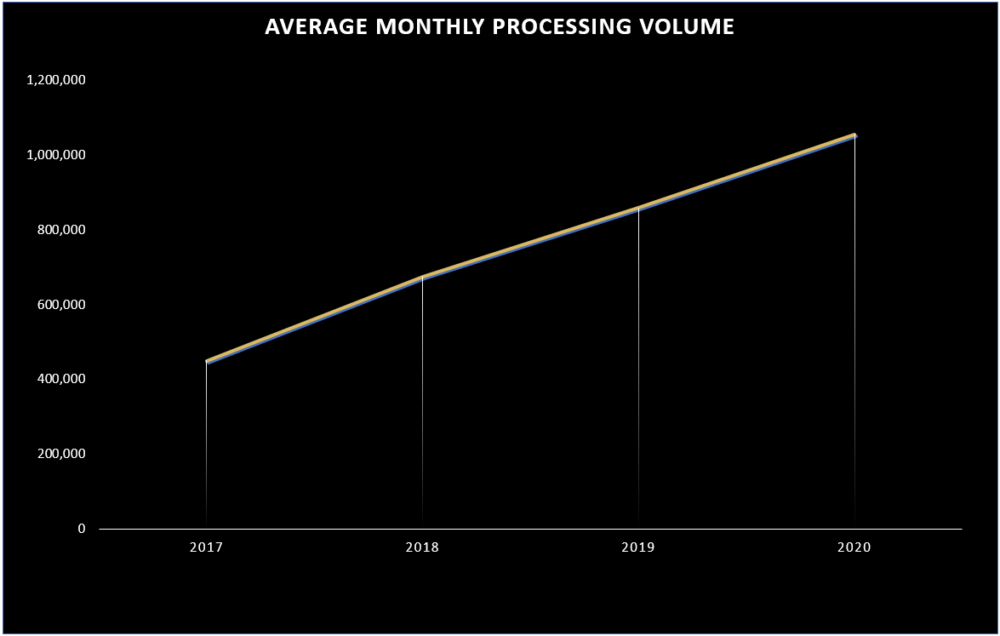

Operating primarily in the United States in the high-risk online course industry, which sees tremendous demand and involves a lot of players, DCC brings in about US$1.5 million in sales per month, with about 6-7% chargebacks.

DCC has done and relied on online marketing since 2002 and processed online payments independently since about 2006-2007. Until about 2017, they found themselves cycling through a variety of PSPs—partnerships that tended to be short-lived and that never truly instilled tremendous confidence in R., the founder and CEO of DCC. At one point, he says, DCC was working simultaneously with an American PSP and two European ones.

Recalling those times, R. shares, “I remember feeling concerned about how our payments would be handled, and worrying that the process might be carried out without any monitoring or guarantees.”

Likewise, the terms rarely felt aligned with DCC’s needs, especially when it came to the company’s regular transaction volume, for example. His concerns, unfortunately, came to the fore after one of DCC’s PSPs shut down the company’s account, seizing about half a million dollars that were never recovered and in turn almost putting DCC out of business.

“The worst thing that can happen to a business is to have its cash flow stopped…”

Says R. and continues, “Cash flow is the backbone of a business, and if it stops, your business is at risk. As a business owner, you look to build a strong backbone—you need to be able to sit on the beach over a beer and think about how to grow your business, not how to fix it. After the incident with that PSP, it became clear that I needed to find one we could trust, in order to avoid facing the same issue again.”

That led DCC, in 2018, to Fibonatix. The difference in Fibonatix’s approach felt like night and day: “At Fibonatix, you know that someone’s looking out for you, even more than you would expect of a PSP. Their customer service goes above and beyond—they over-deliver. Their understanding of the industry and the challenges business owners face along with their business insights are so professional; that’s what truly sets this company apart from all others. I haven’t encountered this with any other PSP.”

“It’s clear that Fibonatix is an established player in the field—it has strong relationships with some of the best banks, which means it can really look out for its customers and operate in our interest,” says R. “That ethos is reflected in the company and the high-quality people who work with me on a daily basis.”

When asked about how he sees PSPs, R. says without flinching, “Above all, the role of a PSP is to give you peace of mind to focus on your business—that’s what Fibonatix has given me.” For DCC, Fibonatix has not only increased its processing volume by 50% by providing professional business advice and insights, a huge and significant milestone in the company’s growth, but, more importantly, “I feel confident that our money is in good hands, that it’s being taken care of and monitored daily, and that I have a professional partner to work with, one who values professionalism as much as we do.”

Summing it up, R. shares, “I think a lot of businesses in the high-risk industry don’t give much weight to the quality of their PSP—probably because they haven’t had the devastating experience of having their account shut down. Because of that, today Fibonatix is the only PSP we work with.”

*For privacy, company and CEO’s names have been changed