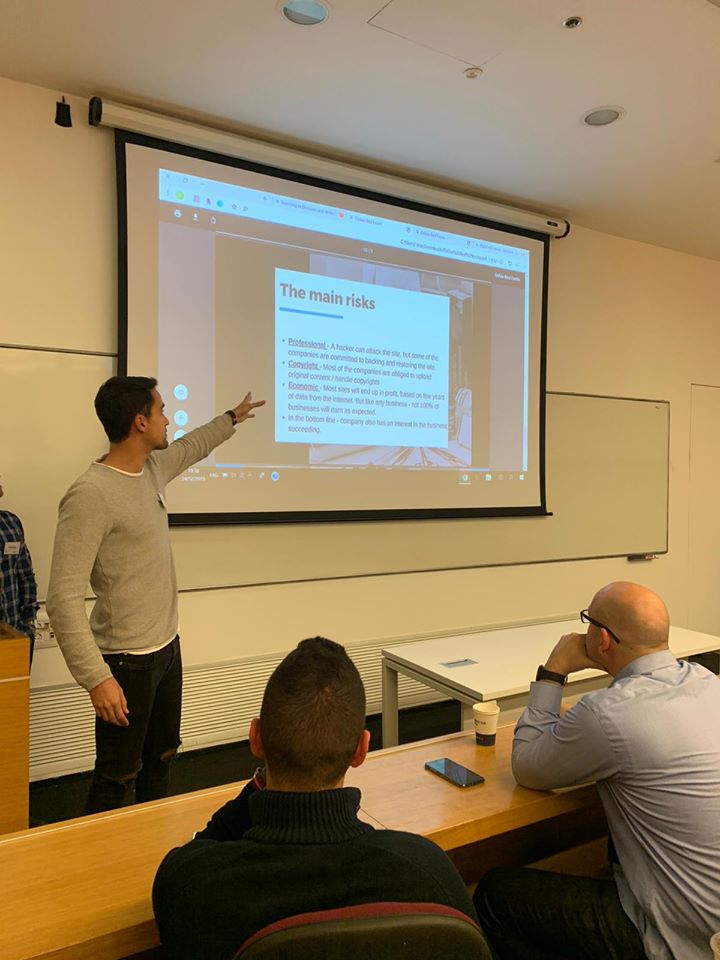

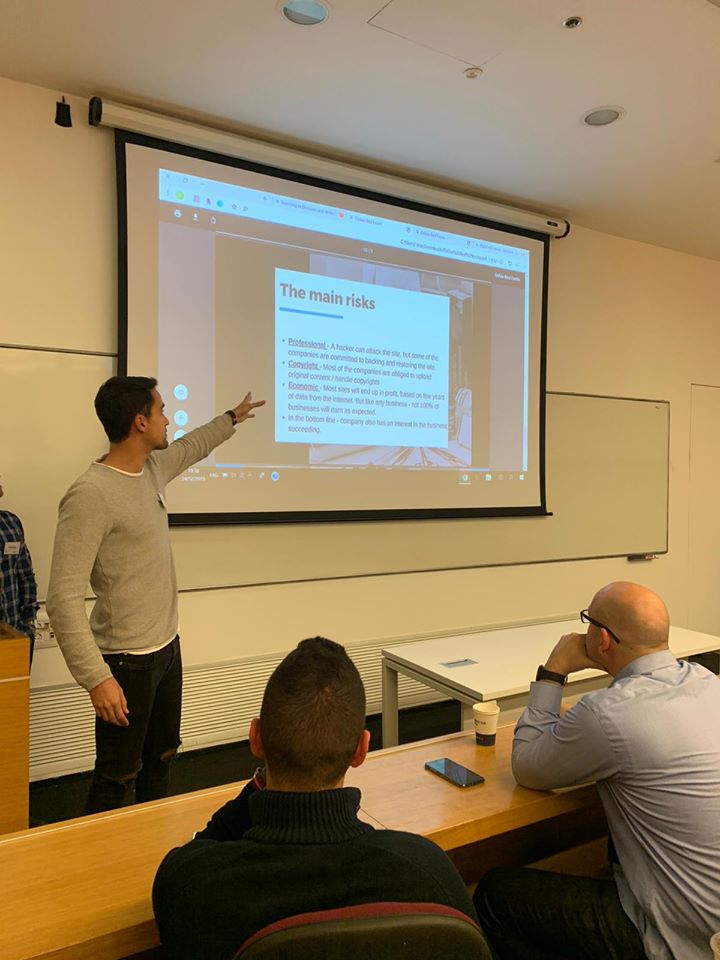

We were super excited to continue our fruitful partnership with Fintech club – IDC!

Thanks guys for another inspiring session and for celebrating Hanukkah with us. 🥳

Happy Holidays! 💛

Share

December 19, 2019

Head of Business Development

We were super excited to continue our fruitful partnership with Fintech club – IDC!

Thanks guys for another inspiring session and for celebrating Hanukkah with us. 🥳

Happy Holidays! 💛