Chargebacks are an accepted reality for merchants across industries, but they can represent a real challenge if not managed effectively. Unfortunately, in a system that’s skewed in favour of consumers, practices like “friendly fraud” go unchecked and create tricky situations where merchants need to defend themselves against untrue accusations and deal with the negative impact chargeback culture can have on business success. We explore the topic of calculating your chargeback-to-sales ratio and how to manage chargeback risk.

This blog’s insights are based on Episode 10 of our Pay Attention Podcast, hosted by Fibonatix CEO Tal Miller. In this episode, Tal explores how chargeback ratios are calculated and how merchants can handle chargebacks effectively when monitoring business risk. Listen via the player below or scroll down to continue reading the blog…

Table of Contents

The need for a change in purchasing culture

Businesses are an integral part of society and unjust payment ecosystems need to be corrected. A just system is one as close to perfectly balanced as possible between all participants in the system, including merchants and consumers. Luckily, card schemes, particularly Visa and Mastercard, are gradually coming to understand this need for change and are starting to adjust the system. However, chargeback-to-sales ratios are still used as an indicator of business performance for both merchants and card schemes alike, meaning that chargeback risk in your business cannot be ignored.

If you’d like to take a step back and learn more about how chargebacks were formed and how they’ve evolved, read our accompanying article: An Introduction to Chargebacks: The Evolution of the Chargeback Process.

What is a chargeback-to-sales ratio?

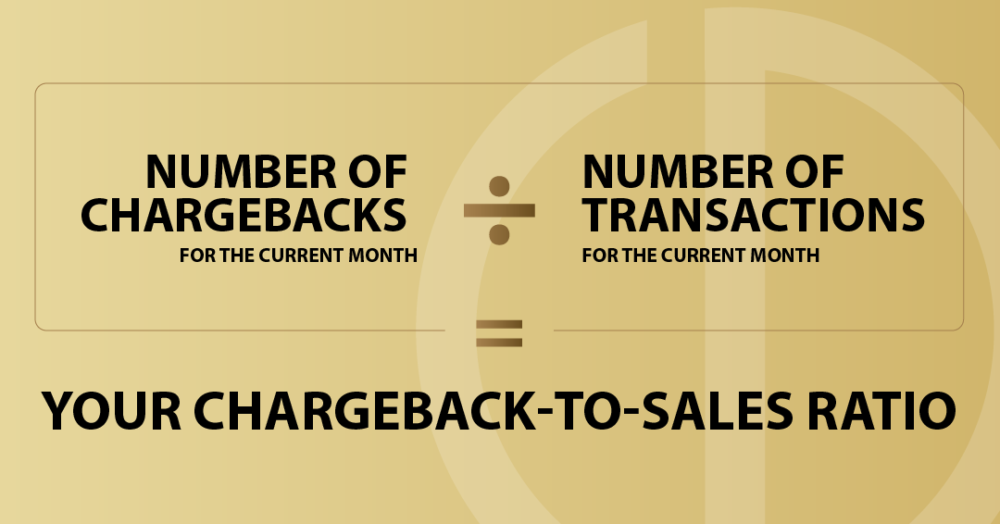

A chargeback-to-sales ratio (or simply chargeback ratio) is a percentage ratio between the number of chargebacks your business has in a month compared to the total number of sales in that month. Chargeback-to-sales ratios are also used as a KPI in the payment industry to evaluate the risk and measure the performance of a business. So, if you exceed a certain threshold, you may be fined and/or put on a monitoring programme by your card scheme.

If chargebacks are an indication of how well your business operates, then your chargeback ratio is very important, as chargebacks represent dissatisfied customers. Based on your ratio percentage, how many dissatisfied customers do you have? Your goal should be to lower this number as much as possible.

Assessing your chargeback-to-sales ratio

It’s important to note that some industries are more prone to chargebacks than others, so it’s necessary to assess your chargeback situation in relation to your industry’s standard. That way, you’ll be able to tell if your chargeback-to-sales ratio is a true indication of your business’ performance or simply part of the cost of doing business in your industry. However, if your chargeback ratio is higher than the industry average, you’ll need to explore why you have such a high number of unhappy customers.

Your chargeback ratio can be a useful metric for forecasting your business’ growth and for proper and sound financial planning. Chargebacks reduce total sales and if they exceed a certain amount, you’re going to have a problem with profit margins. You can get your chargeback data from your payment service provider to calculate your chargeback ratio and assess the financial stability of your business.

How should merchants manage chargeback risk?

If you’re a merchant experiencing chargebacks in your business, it’s important to have a thorough understanding of the reasons and factors that are causing them. Consider what the risk of excessive chargebacks means for your specific company, as the effects differ from business to business.

Start by identifying how many chargebacks your business receives in a given time period and then work out your chargeback-to-sales ratio. From there, you’ll be well-informed enough to find appropriate ways to reduce chargebacks in your business.

3 key steps to mitigate chargeback risk

Once you’ve calculated your chargeback-to-sales ratio, you can then dig deeper into the reasons behind the majority of your chargebacks and what you can do to resolve the issues. Card schemes give different reason codes for chargebacks. Below are the main reason codes to be aware of and the steps you can take to manage chargebacks in each case.

1. Fraud

Bearing in mind that fraud is the easiest reason code for an institution to assign to chargeback transactions, if you notice that most of your chargebacks are a result of supposed fraud, it’s worth implementing systems to reduce or eliminate fraudulent purchases. This includes adopting third-party systems or using payment service providers that offer verification and authentication mechanisms, such as 3D Secure.

2. Customer disputes

If you find that most of your chargebacks are service-related and as a result of disputes, talk to your payment service provider and have them investigate what exactly customers are saying when filing chargeback disputes. Card issuers do put customer claims in writing in the form of chargeback letters and if you’re able to review these and understand what customers are complaining about, you can identify where you need to intervene and improve problems. Issues here include poor service or miscommunication on the part of your staff.

3. Processing errors

When reviewing your chargeback-to-sales ratio, if most of your chargebacks are process error-related, look at your business processes and try to understand where the problem may lie. If your system is automated, for example, there may be a flaw there to investigate. This may include automatic location detection that changes the currency of your prices to suit your visiting customer, potentially risking the customer being charged in the wrong currency if your system experiences any errors. However, if errors are happening due to manual processes, e.g. charging a customer more than once for a single purchase, then better staff training may be required.

An essential part of chargeback management is distinguishing between those that indicate problems that can be actively fixed and the mere costs of doing business, including factors outside of your control.

Measuring your chargeback-to-sales ratio against others and industry trends

Beyond looking at industry standards when calculating and assessing your chargeback-to-sales ratio, it’s also worth looking at industry trends when it comes to the actual reasons chargebacks are processed – are the reasons given in your business similar or different to competitors in your industry? If you don’t have other merchant contacts in your industry to ask, your payment gateway provider should be able to give you chargeback ratios and reasons typically seen in your industry.

It’s also important to look at your business’ previous performance. Take a look at previous months’ chargeback ratios and see if you notice any trends. Periods in which chargebacks increase could be because of seasonal events – many merchants see an increase during the Christmas period. Bear in mind that if your business operates in different countries, you may have various seasonal events to consider throughout the year, but once you’ve identified seasonal influences on your chargeback performance, you can be better prepared in future.

Summary

Chargebacks are an inherent part of doing business that every merchant has to deal with, so the best course of action is to be prepared for chargeback risks and manage them according to your business’ financial situation and industry standards.

Your payment service provider should have more knowledge on reducing your chargeback-to-sales ratio, so it’s always worth talking to them about your chargeback issues. A good payment service provider will support and advise you on how to manage and mitigate risks.

If you’d like to find out more about risk management in payments, explore our risk management services and how we support businesses in managing, rather than avoiding, their risk.

Fibonatix is a global payment service provider offering bespoke payment solutions and supporting services for merchants of all types and sizes. We’re FCA regulated, with offices in the UK, Germany and Israel. We empower businesses with cutting-edge payments processing tools and our vast experience in payments consultancy to drive business growth. Our experts also advise on elements such as risk management, regulatory compliance and business intelligence.