We’re still in the midst of the pandemic and the impact of Covid-19 on business has been clear to see across the globe. Businesses have had to evolve to survive, whilst consumers have adapted to restrictions and their purchasing patterns and methods have changed. We look at the impact of Covid-19 on merchants and payment service providers and how the pandemic has influenced payment processing trends.

The insights in this blog are based on Episode 5 of our Pay Attention podcast, where Fibonatix CEO Tal Miller discusses how Covid-19 has and still is impacting the world of payments. Listen via the player below or scroll down to continue reading the blog…

Table of Contents

What are the main payment processing trends to have emerged from the pandemic?

The global pandemic has changed how consumers shop, how merchants sell and fulfil goods and services and how payment service providers support businesses. Let’s look at the top payment processing trends that we’ve seen as a direct result of the impact of Covid-19.

Changing customer behaviours

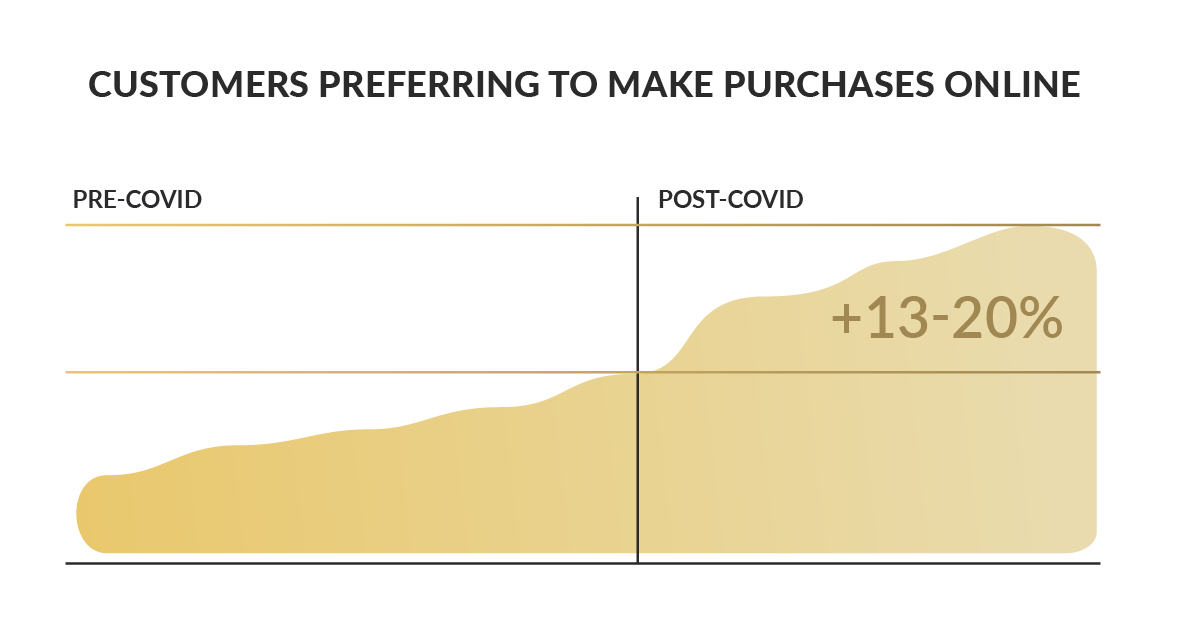

The biggest change in consumer behaviours as a result of the pandemic has been the increase in online shopping and greater adoption of eCommerce. The eCommerce space has grown significantly during the pandemic. There has been a 13-20% increase in customers preferring to make purchases online. Obviously, the number differs depending on the region, but this is the overall increase we’ve seen in 2020. Although eCommerce has been growing year on year, the growth has been exponential since Covid-19 kicked in.

What’s been interesting is that eCommerce adoption is not just dependent on government measures or in direct correlation with businesses that they’ve had to close their physical stores. Businesses not directly affected by government measures, such as grocery stores, drug stores and pharmacies (remaining open due to being deemed “essential”), have seen consumers making online purchases in ever-increasing numbers, rather than going in-store. Many customers were reluctant to leave their house, had to isolate or just favour this newly-embraced convenience.

Convenience becoming high priority, sparking wider eCommerce adoption

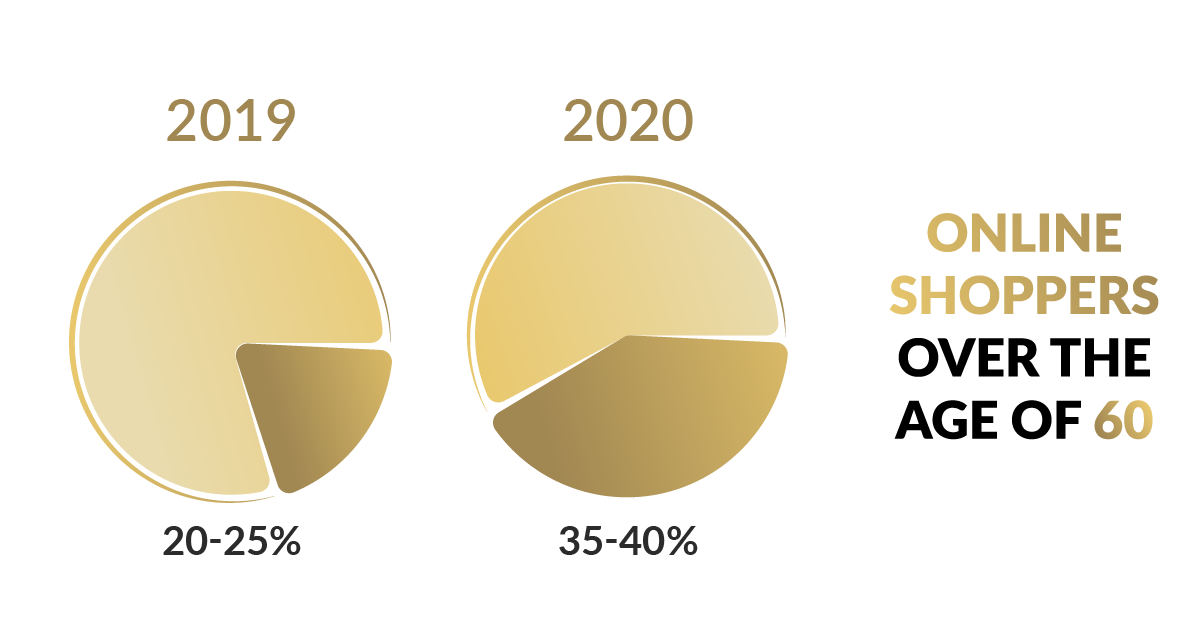

With this rush towards online shopping, eCommerce adoption is expanding into demographics that were traditionally hesitant to use it in the past. The pandemic has forced or influenced a lot of people to change their stance on eCommerce and online shopping.

In 2019, around 20-25% of people over the age of 60 were online shoppers. In 2020, between 35-40% of this same demographic reported that they make the majority of their purchases online. This is a huge shift. Traditionally, older people are slower to adopt modern trends and new ways of doing business.

Although we’re far from being in a position to say for sure what the lasting impact will be, many of the payment processing trends we’re seeing during the pandemic are certainly here to stay post-Covid.

Check out this quote from Gero Furchheim, from Cairo AG: “The coronavirus pandemic has significantly accelerated the development of trade towards eCommerce. Our industry has fulfilled its performance promise. This development will not be reversed. The social and political debate must therefore fundamentally change its perspective. In the future, eCommerce and its processes will be the starting point from which customers begin their shopping. City centres and retailers need this digital foundation to offer their customers added value with their stationery offers.”

I wholeheartedly agree with this sentiment. There were various contributing factors that limited people’s exposure to eCommerce. The pandemic has forced consumers and businesses alike to embrace the concept of selling and buying goods online. Any fears over service, complexity or security from eCommerce have been diluted, if not dispelled completely. Once the threshold has been breached and convenience has taken more prominence in priorities, people are encouraged to continue to do business and make purchases online. This was a growing payment trend before the pandemic and has been accelerated by the global crisis.

Increased risk exposure and fraudulent activity in payment processing

We’ve seen an increase in business risk, as a result of the greater adoption of eCommerce and online shopping. This is influenced by both customer behaviours and the new approaches and volume of fraudsters.

In line with the increase in people shopping online and in a card-not-present environment, there has been a rise in fraudulent activity. Online shopping is still less secure than in-store purchasing, especially in countries that have adopted the EMV protocol – physical shopping using an EMV pin. So, there’s a higher risk involved with the increase of online shopping.

Fraudsters on the march

Fraudsters are always looking to exploit a vulnerability and therefore, conduct most of their fraudulent activity online. Since more purchases are being done online, during the pandemic, and by a wider range of demographics, we’ve seen more fraudulent activity. And some fraudsters have exploited new venues and new opportunities to commit fraud.

There are new scams and more things to be aware of as a consumer and a business in this post-Covid world. Fraudsters have used specific pandemic-related exploitation both on and offline, such as fraudulent sales of pandemic essentials (especially during lockdowns), fake sanitiser and vaccines, and other opportunistic schemes. And we’ve seen mail and delivery scams exploiting the increased volume of online orders, encouraging people to click on links and pay for things that they shouldn’t have to, and various other scams related to banks and other institutions to get people to make payments to accounts that have nothing to do with these organisations.

Chargeback culture

There’s also been an exponential rise in chargebacks. Legitimate chargebacks, like those seen in the Tourism industry, where many people haven’t been able to take flights or use hotels and had no recourse other than to chargeback, have increased. And there’s also been a spike in illegitimate chargebacks (so-called friendly fraud). One reason for this is due to a large number of people being in a difficult financial situation as a result of the pandemic and finding ways to work the system, whereby they purchase something, enjoy the service but avoid paying for it. Many people have discovered that they can do this and not be punished, which then leads to people doing it again, with various products and services.

From our experience, most of the people perpetrating these kinds of chargebacks are repeat offenders. It might start from a more legitimate chargeback, being compensated for a faulty product or a service that didn’t meet expectations, and gradually become a habit – it’s a slippery slope with users exploiting the system due to the ease of the process.

Changes in merchant and PSP methodology and operations

During the pandemic, payment service providers (PSPs) faced various challenges that have affected merchants and other organisations; working remotely, people being sick/quarantining, decrease in turnover, etc. As businesses impacted by the pandemic have lost revenue, stopped processing payments or even shut down, it’s had repercussions for PSPs. In addition, PSPs have needed to make various changes to their approach due to new consumer behaviours and increased risk, understanding they had to adapt to the situation and evolving payment processing trends. The biggest challenges were (and are):

- Dealing with the increased risk

- Dealing with an ever-increasing demand for digital services

Because consumer behaviours have changed, there is a lot more demand for digital services on behalf of merchants. In turn, these merchants are demanding more from their PSPs, such as online payment gateway services, different payment acceptance methods (including APMs) and enhanced payment data and reporting. Some providers are more successful in adapting to these new challenges and quicker to react than others.

Listen to the podcast on this topic and explore other episodes from our Pay Attention podcast: How COVID-19 Affected/is Affecting Payments.

Summary: Adapt to new payment processing trends to survive and thrive

These challenges for businesses remain in 2021 and the impact of ongoing changes to consumer behaviours and payment trends will reverberate post-pandemic. The merchants and PSPs that adapt to these new demands and purchasing preferences and address new risks that have arisen will be those that thrive in the new normal.

The shift to online payments will only increase and businesses need to embrace this and optimise their processes to cope and offer easier ways for customers to complete transactions. Those businesses that previously have no online element need to consider having an online arm and learn how to best cater for those preferring to make payments digitally.

Want to learn more about new payment processing trends? Get in touch. Or browse our range of payment processing solutions and supporting payment services.

Fibonatix is a global payment service provider offering bespoke payments solutions and supporting services for merchants of all kinds. We’re FCA regulated, with offices in the UK, Germany and Israel. We empower businesses with cutting-edge payments processing tools and our vast experience in payments consultancy to drive business growth. Our experts also advise on elements such as risk management, regulatory compliance and business intelligence.